Bitcoin enthusiasts believe it could change the way we think of money, and severely disrupt the existing financial infrastructure centered around banks and government issued fiat currencies. We will talk more about the potential and impact of Bitcoin in another article, but in this one the idea is to explain, in a nutshell, what Bitcoin actually is, why you might want to get involved, and how do you go about doing so.

What is Bitcoin

What is Bitcoin

In short, it is an open source peer to peer digital cryptocurrency and payment system. It is designed to allow people to transact with a greater level of anonymity and security, but with the convenience and speed that rivals that of PayPal.

Its design also makes it inflation proof, as there is a hard set limit of 21 million bitcoins, which is how much there will ever be in existence. As a result, contrary to other currencies, its value is more likely to go up in time rather than depreciating. The more people buy into bitcoins and start using it regularly the more valuable they become relative to other currencies.

Bitcoins, abbreviated as BTC, are stored in digital wallets and transmitted via Bitcoin addresses, which are long strings of numbers and letters. These wallets are encrypted for security, and should be backed up in order to protect from losses. If you lose a wallet you lose the bitcoins that were in it, much like with physical wallets.

Bitcoins come into existence through a process known as “mining”, which is about solving hard mathematical problems that in turn actually help strengthen the cryptography of the entire Bitcoin network. Therefore to mine bitcoins it is necessary to dedicate some computing power, and the more bitcoins are mined, the harder these problems become, and the more computing power is necessary.

This is what, many argue, gives Bitcoin intrinsic value. Besides the fact that you’re literally turning electricity into computing power and finally into Bitcoins thereby creating a clear link between physical energy and a virtual coin, the result of this process is also a cryptographically stronger network for all Bitcoin users. And finally, there’s the utility value found in its decentralized, borderless and pseudonymous nature, and the ease with which you can accept and send bitcoins.

Why Bitcoin

Perhaps one might ask the many disenfranchised cypriots for the best answer to this question, as they got plundered by the very system they put their trust into for so long. This might in fact prove to be the biggest motivator for the rise of Bitcoin; the rapidly declining trust in the existing banking system and the institutions which prop it up. Our money loses its value all the time. Dollar today is worth a tiny fraction of what it used to be worth before it was taken off the gold standard, and the last financial crisis has led governments to “fix it” by creating an inflationary bubble that is likely to pop within a decade.

Our money, and our entire financial system, is in trouble. It is quite prudent to be asking ourselves if perhaps there may be a better way, something different. Digital currencies which nobody controls, in which trust is placed on the network of peers and the peer reviewed open source code rather than politicians and bankers, and which cannot be inflated at will, might prove to be a compelling candidate for such an alternative.

But momentarily, you might like to buy and try using some Bitcoin for one of these three more immediately practical reasons:

1. It allows you to easily buy certain things online (and even offline in some places), perhaps in some cases even easier than PayPal (the use of which is still limited in some regions).

2. It allows you to receive money easier than just about anything else. Have something to sell? Accepting Bitcoin for it is, in a nutshell, as easy as putting up a price and your address. Bitpay also offers an easy to use service for accepting Bitcoin.

3. Bitcoin will likely rise in its value in the long term; significantly so. While the last rally may have been a “bubble”, it still left BTC higher than it was before the rally started, and the interest in it continues to grow. The more people get involved and demand bitcoins the more valuable relative to US dollars it will become. Some also call it digital gold, implying its potential as an alternative hedge to gold and silver. Don’t put all your life’s savings into BTC, or anything silly like that, but getting involved at least a little bit may do you good in the end.

How to Buy

So how do you buy Bitcoins? There are many ways, but before we get into the business of exchanging your dollars, euros, or other currency into BTC, you need to get yourself a wallet.

Getting a Wallet

There are two ways to go about getting a Bitcoin wallet. One is to use an online wallet service, which is the easiest and quickest option, and the other is to download a wallet program and set one up on your own computer.

If you wish to set up a wallet online an often recommended service is blockchain.info, which allows one click and regular backups, two-factor authentication, and easy creation of multiple addresses for different kinds of transactions. This is probably as good as it gets as far as online wallets go, so far. However, it is not inconceivable for the site to become slow, unresponsive, or go down due to high load or a DDoS attack, and the possibility of it getting hacked can’t be entirely thrown out either (however unlikely it might be at this point).

If you’re really paranoid you can opt for a local wallet, that is, a wallet stored on your own computer. But for this you’ll need to invest a little bit more work.

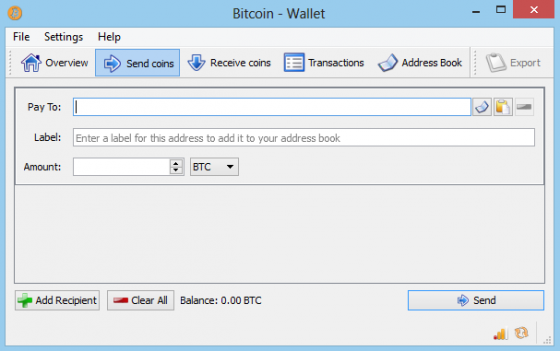

Bitcoin.org recommends a number of wallet applications for you to choose from. The original one, which is still widely used, is Bitcoin-QT (also known as the Satoshi wallet), but it can be quite slow in initially downloading the blockchain before you can start using it. However, if you use Bitcoin-QT you can use Armory with it, which provides some extra features that help you keep a more secure wallet while still being easy to use.

If you wish to skip the daunting blockchain download you might want to consider Electrum, which can use blockchains already stored on various servers, so you don’t have to download it all to your computer. Yet you still have your actual wallet stored locally.

Once you set up a wallet you will get an address, and the client will also typically allow you to create more addresses. You can have as many addresses as you wish. Giving out any of your addresses to someone for payment will allow them to pay into your wallet. Addresses are like conduits between Bitcoin wallets. They can be temporary or permanent, and they can be many or just one.

A Word on Anonymity

It is a good idea to use multiple addresses for different transactions as this makes your transactions harder to trace back to you. Of course, if you put up your address on a web site with your name on it everyone will be able to know that bitcoins going to that address are going to you. Bitcoin doesn’t necessarily provide total anonymity. It depends on what you associate your addresses to, how many of them you use, and for which transactions do you use them.

Bitcoin addresses and transactions between them are public, and stored in the blockchain that is kept in many copies across the entire network. Every time you send or receive bitcoins this transaction can be seen by anyone, but they only see those addresses, and the amounts going back and forth. There’s no way to know for sure that they belong to you unless you explicitly associate these addresses with yourself or otherwise leave some clues with your transaction patterns. Ideally for each transaction you could use an entirely new address, making it next to impossible to know who’s behind all that activity.

Buying Bitcoins

US residents will typically find it easiest to buy Bitcoins using such options as direct deposits from US bank accounts. Residents of eurozone countries with bank accounts tied into the SEPA system should also find it fairly straightforward. Residents of other countries may have to go through a little more hassle, but decent options still exist.

Here are the ways to buy Bitcoins:

Bitcoin Exchanges

They support direct deposits, wire transfers, or other payment options (credit cards, OKPay, Dwolla, WebMoney.ru, SMS etc.). Examples include MtGox.com, BTC-E.com, Coinbase.com, Blockchain.info, and others. They also typically provide some additional service such as Coinbase offering merchants a way to accept Bitcoins and Blockchain.info a view of all transactions in the Bitcoin blockchain.

Redeemable Codes

Perhaps the easiest method of buying bitcoins is to buy a redeemable code for dollars that you can then redeem into bitcoins. GiftCoins.me are a great example of this, and some bitcoin gift cards were available for sale through Jagoo. They are now out of stock, but perhaps they restock them later. The great thing about this is that you can pay via PayPal or Google Wallet skipping the potentially arduous or expensive process of linking a bank account, doing a wire transfer or going through other relatively more daunting options of funding your Bitcoin exchange account.

Via other virtual currencies (e.g. Linden Dollars at VirVox.com)

This option isn’t as easy or as fast, but it is another way to buy Bitcoins with PayPal. VirWox.com allows you to buy Linden Dollars and a couple of other virtual world currencies, and then exchange them for Bitcoins that can then be withdrawn to your Bitcoin address. The downside to this is that there is a daily limit of $65, about $10 dollars ends up lost in fees and conversion, and there is a delay of up to 48h for the Bitcoin withdrawal to be processed, although after a few withdrawals the requirement of manual verification may be lifted.

Bitcoin-OTC (Over The Counter trading online)

It is possible to buy Bitcoins directly from other Bitcoin owners via a mutually agreed upon payment method (often PayPal). You need to join an Internet Relay Chat channel on Freenode called #bitcoin-otc, and then express interest in buying bitcoins.

The catch is that you have to be extremely careful about fraud, which is why they have a Web of Trust that you can use and participate in to ensure that who you are interacting with can be trusted to deliver. I believe participation in the web of trust is optional though; you can take a risk and just transact with a random stranger that you find there, or come up with your own way of verifying that you can trust that person.

You can find out more about #bitcoin-otc on its web site, along with the information on how to set yourself up with their web of trust.

Local Bitcoins

Finally it is possible to buy bitcoins from people who have them in your area, either by meeting face to face and exchanging local currency for Bitcoin on the spot (he or she can make the transfer using a smartphone app or a laptop immediately) or by sending money through mail. You can find people with Bitcoins in your area on LocalBitcoins.com. There is also a feedback system to help you establish trust in the person you would be buying from, and the sellers also leave instructions as to how they want the transaction to be done.

Other Routes

There may be various other ways for you to convert your fiat currency into bitcoins, and there are a couple of web sites which can help you do that. One is GetBitcoin.info (actually residing on bcfxer.appspot.com) which allows you to specify what you have (in terms of other currencies, codes, accounts etc.) and what do you want (e.g. bitcoins in your Mt.Gox wallet). It will then provide a “route” you can follow to accomplish that, and what it might cost you.

Bitcoin Wiki has a comprehensive table of options for buying bitcoins. Be sure to check it out.

How to Sell

Most of the same methods used for buying Bitcoins can be used to sell them. Typically the actual exchange of Bitcoins for dollars should be straightforward, and the main worry will be how to withdraw to your bank account, PayPal or other account you use for spending dollars.

The cool thing, however, is how easy it is to move bitcoins between various bitcoin accounts or wallets. If, for instance, the service you are using right now doesn’t have the withdrawal options that work for you it is very easy to just send bitcoins to an address you have with another service where better withdrawal options exist. For instance Blockchain.info doesn’t offer a direct deposit to an US bank account, but Coinbase does. So you can simply send bitcoins from your Blockchain.info wallet to an address you have in Coinbase, and then do an exchange and withdrawal there.

That said depending on the exchange you will likely have the option to make a direct deposit to your bank account, a SEPA transfer, or a wire transfer. If you would like to get paid to PayPal Blockchain.info (and possibly others) offer a BTCPak option. You get a moneypak and redeem it to your PayPal account. This is available only for US residents though.

For those who wish to get paid to PayPal, but aren’t in the US, #bitcoin-otc or Bitcoinary can be used or finding someone who sells bitcoins locally and is willing to pay you for them via PayPal. Or you can create a Mt.Gox redeemable code and sell that for a PayPal payment.

For more options and alternate “routes” you can try GetBitcoin.info (bcfxer.appspot.com) or BitInstant.

Bitcoin Wiki also has a comprehensive table for selling bitcoins, which you may find useful.

Where to Spend

This is the fun part, simply because it is so easy, cheap, and fun to spend bitcoins. There are no boundaries, and there’s already lots you can buy with them.

In fact, I started listing all the things you could buy with bitcoins and quickly realized that just saying “everything” would be more efficient. You can, indeed, buy everything from digital products and services like web hosting, domains, music, movies, steam games (via codes) to computers and electronics to clothing and food. Most stores are probably US based, but this is likely just a start. For a comprehensive list of places which accept bitcoin go to SpendBitcoins.com/places/, and you might be surprised at what you find!

Some of the better known brands that accept bitcoin are WordPress, Reddit, Namecheap, OKCupid, MetArt and more are coming in. The community of bitcoin enthusiasts are actively trying to get more well known stores and brands, such as Amazon.com (here’s a petition), to join the Bitcoin economy. This will hugely help in establishing Bitcoin as a mainstream currency and payment method.

Especially notable mentions among Bitcoin exclusive stores is BitcoinStore.com, which offers a huge selection of goods in a wide variety of categories, and BitMit.net, a bitcoin oriented auction store (like ebay).

Bitcoin Mining: How Bitcoins Come into Existence

We wont go into much detail on Bitcoin mining here because it is increasingly becoming difficult and unprofitable for most users, but in a nutshell what you need to mine bitcoin is powerful computer hardware, a bitcoin mining application running on it, and ideally an account with a mining pool which helps with the efficiency.

Once the hardware and software is set up, which is by itself fairly straightforward, it’s just a matter of keeping it running for as long as possible.

While there’s still a chance of limited success with powerful computers using powerful graphics cards (since bitcoin mining benefits more from Graphical Processing Units (GPUs) at this point than CPUs) the mining business is increasingly moving to specialized hardware known as ASIC’s, dedicated to Bitcoin mining.

The more people mine, and the more bitcoins are mined, the more difficult it gets. This parallels the mining of real world gold and silver. The easy pickings go first (the gold rush), but then it becomes more difficult and requires a lot more resources. This is just one of the reasons some think of Bitcoin as a kind of digital equivalent to gold.

Conclusion

Bitcoin is the first digital cryptocurrency to make it this far and prove that something like this could actually work as an alternative to traditional currencies we’re using today. It has some significant benefits, namely, the increased anonymity and privacy, decentralization of trust eliminating the possibility of large scale economic manipulation, the impossibility of endless inflation and depreciation, its global and borderless nature, low cost, convenience, and high efficiency with which transactions can be done.

If you see value in that, and a long term potential, you might want to get some and start spending some yourself, and see how it goes. As we can see from the above it isn’t very difficult to get set up, there are plenty of ways to buy some, and there are many things you can spend them on. What happens next we will see, but I’d wager that the Bitcoin economy is going to expand, and that will lead to some very interesting times.

We are open to updating and improving this guide so feedback in comments is quite welcome.

Resources

- Bitcoin Project

- Bitcoin Wiki

- We Use Coins

- Bitcoin Foundation

- Bitcoin price (bitcoinity.org/markets)

- Bitcoin subreddit

Follow Us!